nassau county tax grievance status

If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance. We welcome feedback on ways to improve the sites.

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

The Nassau County Tax Collector is committed to an ongoing process of providing accessible content to all website visitors.

. Know that your grievance is in the best most competent hands possible. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with our marketing.

Search for jobs related to Nassau county tax grievance status or hire on the worlds largest freelancing marketplace with 20m jobs. The Department of Assessment is responsible for developing fair and equitable assessments for all residential and commercial properties in. While SmartAsset places Nassau Countys average tax rate at 224 it is worth remembering that property tax amounts and percentages vary based on individual municipalities.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance. How to Challenge Your Assessment. Last year for the 2019-20 tax roll the commission received 36000 appeals from homeowners who represented themselves.

Nassau New York Rights Not Assigned. Access your personal webpage or sign date and return our tax grievance authorization form prior to the deadline Nassau Countys deadline to file a property tax grievance is. Any homeowners in Nassau that misses the Property Tax Grievance deadline of March.

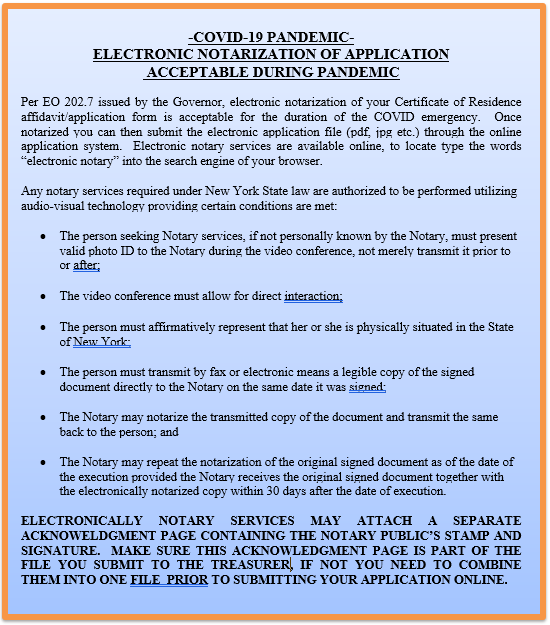

This is the total of state and county sales tax rates. Under New York State Law filing a Property Tax Grievance cannot raise your Nassau Property Taxes. Nassau County residents have a right to file a property tax grievance if they feel that the assessed value of their property has been incorrectly determined.

The Assessment Review Commission ARC is an independent agency separate from the Nassau County. About the Department of Assessment. Again well keep you in the loop with regular communications as your case makes its way through ARCs review.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance. You have nothing to lose only money to save. However the property you entered is not located in Nassau County and we only file tax grievances for Nassau County properties.

At the request of Nassau County Executive Bruce A. About 6000 were filed on paper and 30000 were. Paying too much nassau county property tax.

Assessment Challenge Forms Instructions. Any person who pays property taxes can grieve an assessment including. At the request of Nassau County Executive Bruce A.

Its free to sign up and bid on jobs. Given that multiple years tax. If youve already received a marketing piece from us you can simply access your.

WELCOME TO THEASSESSMENT REVIEW COMMISSION ARC WEBSITE. This is done by filling out an. To give you an.

It would be our pleasure to assist you. Hiring Maidenbaum to file a Nassau County tax grievance on your behalf is quick and easy. Tenants who are required to pay property.

We will help you file your tax girevance online free.

Nassau County S Property Tax Game The Winners And Losers

How To Appeal Your Property Tax Assessment Village Of Upper Brookville

New York S Broken Property Assessment Regime City Journal

Nassau County Small Claims Assessment Review Filing Period Delayed Due To Coronavirus Herald Community Newspapers Www Liherald Com

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nassau County Property Tax Grievance Realty Tax Challenge

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County To Accept Tax Assessment Grievances Until March 17 Long Island Weekly

How To Appeal Your Nassau County Assessment Recorded March 13 2019 Youtube

Heller Consultants Tax Grievance Home Facebook

The Tax Grievance Process And How It Works Property Tax Grievance Heller Consultants Tax Grievance

Nassau County New York Grievance Period Extended

Nassau County District 18 Updates Next Tuesday Join Us And The Nassau County Assessment Review Commission For A Free Virtual Tax Grievance Workshop All Property Owners In Nassau County Can File

5 Myths Of The Nassau County Property Tax Grievance Process

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Pravato To Host Free Property Tax Assessment Grievance Workshop Town Of Oyster Bay

Breaking Down Oceanside Taxes Taxpayers Receive Rebates In Mail But Why Herald Community Newspapers Www Liherald Com